What the April 2025 Tax Changes Mean For You

The new tax year starts on 6 April 2025, and like every year, it brings some changes. This guide breaks down what you need to know, what the changes mean for you, and how we are supporting you as a Quartz client.

Got any questions?

Give our friendly, expert team a call on 020 3137 4408 or email us at info@quartzpayroll.co.uk

1. Employer National Insurance

Employer National Insurance Contributions are increasing.

You can check your NI costs with our salary calculator. The rate of employer National Insurance Contributions (NICs) has increased from 13.5% to 15%. The threshold at which employers are liable to pay National Insurance (the Secondary Threshold) has reduced from 6 April 2025 to £5,000 per year.

The Secondary Threshold is the point at which employers become liable to pay National Insurance Contributions (NICs) on employees’ earnings.

The government will reduce the Secondary Threshold to £5,000 a year from 6 April 2025 until 6 April 2028.

2. Employee National Insurance

There is no change to your employees’ national insurance rate from April 2025, this remains at 8%.

National insurance thresholds for 2025/26 remain at 8% for earnings above the primary thresholds.

The class you pay depends on your employment status and how much you earn. If you are working age and earn less than the National Insurance Primary Threshold or Lower Profits Limit you will pay nothing.

Employers will only pay on earnings above the Secondary Threshold.

3. Employment Allowance

The Employment Allowance is increasing.

Employment Allowance allows eligible employers to reduce their annual National Insurance liability up to the annual allowance amount.

The government will increase the Employment Allowance from £5,000 to £10,500 per tax year, and remove the £100,000 threshold for eligibility, expanding this to all eligible employers with employer NICs bills from 6 April 2025.

If you have previously claimed Employment Allowance we will automatically continue to apply this.

If you are now eligible to claim due to the threshold being removed or you have not previously claimed, please complete this form and return it to us, in order for us to apply this to your account from April 25.

4. Tax Thresholds

There is no change to the tax thresholds in 2025.

The amount of Income Tax you deduct from your employees depends on their tax code and how much of their taxable income is above their Personal allowance.

The personal tax allowance normally increases slightly each year, but the threshold for 2025/26 has been frozen at the limit of £12,570.

5. Statutory Payment Rates

The Statutory Payment Rates for Maternity Pay, Adoption Pay, Paternity Pay, Shared Parental Pay, and Parental Bereavement Pay have increased.

The first six weeks of Statutory Maternity Pay (SMP) and Statutory Adoption Pay (SAP) remain the same, at 90% of the employee’s average weekly earnings (AWE). The statutory weekly rate for the remaining 33 weeks will increase from April 2025 and will be £187.18 or 90% of the employee’s average weekly earnings, whichever is lower.

Statutory Paternity Pay (SPP), Statutory Shared Parental Pay (SPP) and Statutory Parental Bereavement Pay (SPBP) will all share the same weekly rate of £187.18 or 90% of the employee’s average weekly earnings, whichever is lower.

6. Statutory Sick Pay (SSP)

Statutory Sick Pay has increased by £2 per week.

The same weekly Statutory Sick Pay rate applies to all employees, however, the amount you must actually pay an employee for each day they are off work due to illness (the daily rate) depends on the number of qualifying days they work each week.

The weekly rate for Statutory Sick Pay (SSP) will increase for 2025-26 from £116.75 to £118.75.

7. Benefits in Kind

We can complete a submission to HMRC for any taxable benefits you are providing your employees with for £15.00 + VAT per submission.

All you need to do is let us know what the benefits are, and we will submit the P11D on your behalf. Some examples of benefits are a car for personal use, insurance, and gym membership etc.

As P11D’s must be submitted to HMRC by 5th July, we request that you declare to us the necessary information by 30th April, so we can prepare your P11D in good time. Late submissions may result in HMRC fines.

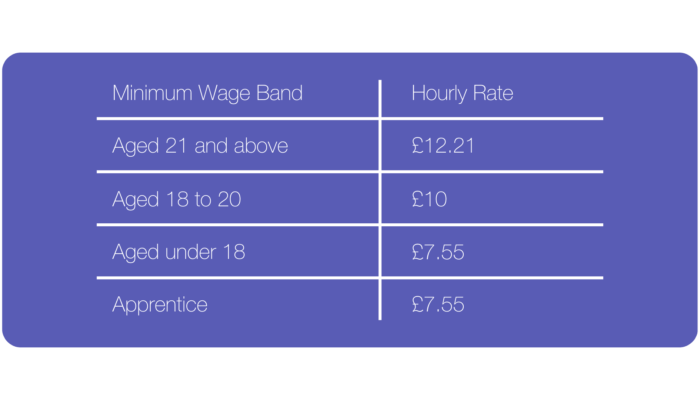

8. National Minimum Wage

The National Minimum Wage and National Living Wage have increased for tax year 2025-26.

As an Employer you have a legal obligation to be compliant. With this in mind, please refer to the table below. If, based on the table below, you find that you need to adjust your employee’s salary, please drop us an email in time for changes to be made for the April payroll. This represents an increase of £1,400 to the annual earnings of a full-time worker on the NLW and is expected to benefit over 3 million low paid workers across the UK.

Updated March 2025